This is the second in a series of papers on the classification of green bonds and the systemic risks associated with market distortions of a green premium. We compare pairs of green with standard bonds, for the green premium and bond ratings.

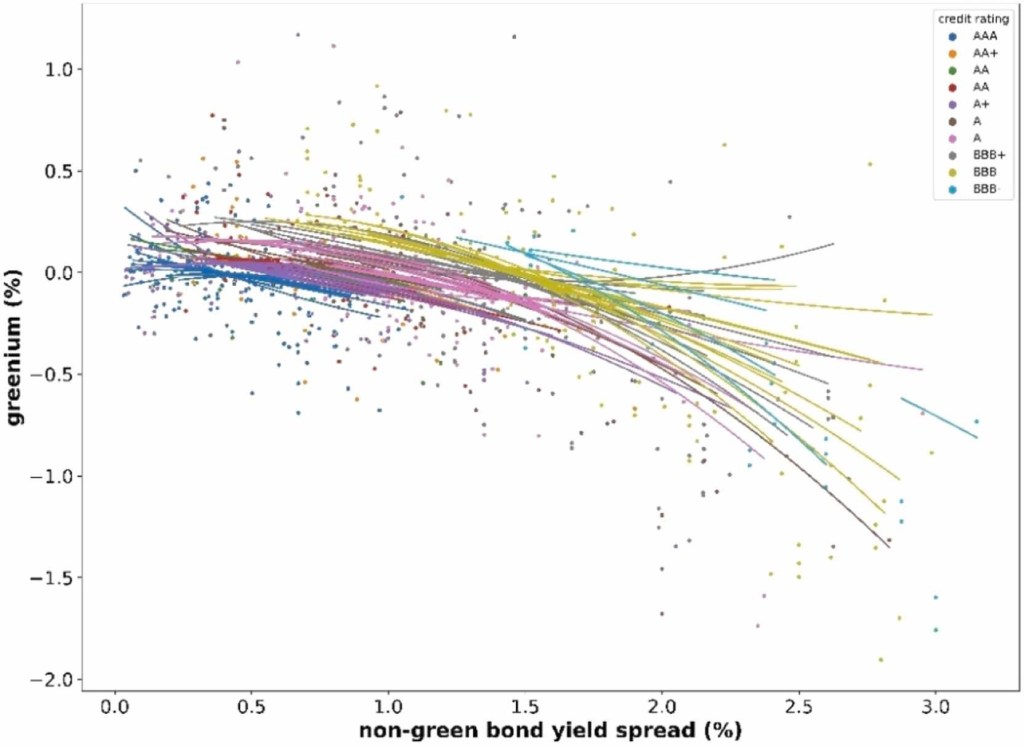

Financial markets allow a premium to green bond issuers (a.k.a. greenium), which incentivises the transition to green projects. This premium also absorbs costs associated with green bond certification, necessary to prevent greenwashing, and aimed at reducing investors’ uncertainty. Several taxonomies have been created to classify bonds to that end. A question is to what extend are such classifications an effective means as traditional credit ratings serve a similar, more generic purpose? And what is the possible effect on market efficiency of these classifications? An observed variance in green bond premiums across different bond classes would also suggest that charges for the certification of green bonds should vary. Difference in greeniums reveal differences in the way the markets assess distinctive classes of green bonds. Especially, when bond classifications change, or taxonomies are ambiguous this could lead to adverse selection or invite greenwashing. Here we compare 858 pairs of matched green and non-green bonds and use a mixed effects model to estimate how bonds’ greenium differ over credit ratings and ‘Use of Proceeds’ categories. Results show that lower-rated bonds reach higher levels of green premiums, controlling for categorical random effects. Similar effects are found for ‘Use of Proceeds’ classes. However, compared to either of the two other classifications a cross-classification model provides significant improvement, demonstrating the added value of green bond taxonomies for investors. This solves a paradox in the literature that found that high score ESG bonds, but also low credit rated bonds receive a higher premium. The other implication is that market inefficiencies may occur due to segmentation since it is common practice for certification costs to be flat and independent from greenium levels. Counterintuitively, creating a green taxonomy could lead to more uncertainty and adverse selection for “true” green project financing, which would delay the green transition and the desired shift to a low-carbon economy. An implied remedy is to implement differentiated verification charges for green bonds across bond credit ratings.

Quarterly Review of Economics and Finance 104, 2025

Leave a comment